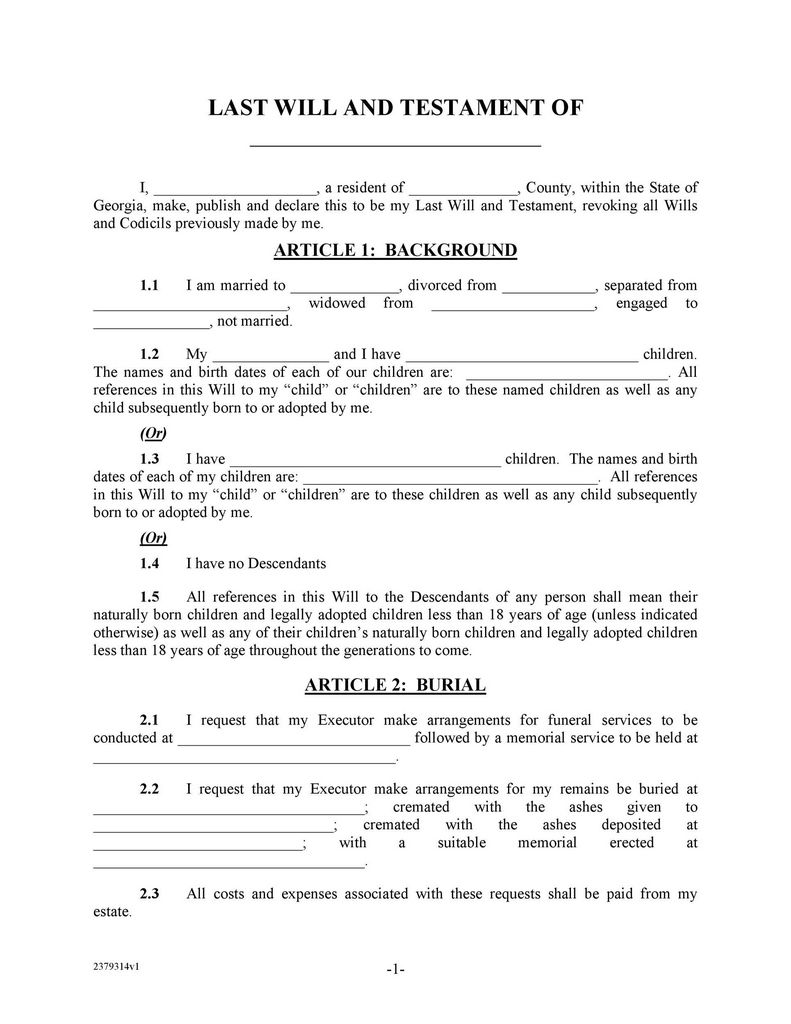

A last will and testament is a lawful document that communicates a person’s last desires relating to their properties. It supplies particular instructions concerning what to do with their belongings. It will show whether the dead leaves them to one more person, a team, or wishes to donate them to charity.

A last will and testimony can additionally handle issues entailing dependents, the administration of accounts, and economic rate of interests. Some states permit non-standard or uncommon wills, such as a holographic will, while others do not.

How a Last Will and Testament Works

A will certainly and last testimony guides the disposition of your possessions, such as bank balances, home, or valued properties. It will information who is to receive building and in what quantity. It can establish guardian arrangements for enduring dependents. If you have an organization or financial investments, your will certainly can define who will obtain those assets and when. A will additionally enables you to guide properties to a charity (or charities), or to an institution or an organization.follow the link codicil instructions At our site

A person writes a will certainly while living. Its instructions are just performed as soon as the specific passes away. A will names an executor of the will. That person is in charge of carrying out the estate. A probate court normally supervises the executor to make certain that the desires specified in the will are performed.

A will certainly and last testimony can create the structure of an estate strategy and is the essential tool used to ensure that the estate is resolved in the manner desired by the deceased. While there can be more to an estate strategy than just a will, the will certainly is the presiding file that a court of probate makes use of to direct the settling of an estate. Any properties that have assigned recipients, such as a life insurance policy policy, qualified retirement plan, or broker agent account, are not included as probate possessions and pass straight to the recipients. While lots of people get aid with their wills from a legal representative, this is not necessary to make most wills lawful and binding.

What Shouldn’t Be Consisted Of in a Will

- Residential property you hold collectively with somebody else

- Funeral plans: these ought to remain in a different document conveniently available after fatality by household or administrator

- Life insurance plans and pension: these ought to have beneficiaries marked on the account forms so they bypass probate and flow directly to the designated recipients

Always Preventing Probate

While some wills do prevent probate, residential or commercial property that your will routes ought to go to certain beneficiaries (whether people or organizations) may still be bound in probate court for months before it can be dispersed according to your dreams.

Along with time and effort, the probate procedure involves legal fees connecting to a legal representative, the executor, and the court.

Routing Funeral Service Plans

A will certainly shouldn’t consist of directions for funeral arrangements. That’s because, generally, it will not be reviewed for time after fatality. Be sure to leave guidelines for funeral setups in a separate document that’s quickly accessed by the administrator or a family member.

Making Certain Conditional Gifts

Gifts that you present via a will can not feature particular problems connected. For example, they can’t be contingent on the marital relationship of a recipient, the divorce, or their religious beliefs. Nevertheless, some conditions might be allowed.

Reducing Estate Taxes

A will does not allow you to minimize or stay clear of taxes that will be owed on your estate.

Leaving Money to Family Pets

Family pets can not possess residential property, so if your dog, pet cat or various other pet dog is very important to you, you can think about leaving them to a trusted person that will certainly give them with a caring home or locate one for them. Your will can offer that individual with money to help them care for your pet dog(s).

Planning Care for A Person With Special Requirements

To provide long-term take care of a loved one with unique needs, it’s ideal to set up a special needs count on. The trust can route the care and offer ongoing revenue, without influencing the advantages they can also obtain through government programs.

Rapid Fact

Addenda to the will, such as a power of attorney or a medical directive, can route the court on how to handle matters if an individual ends up being physically or mentally incapacitated.

Last Will and Testimony Needs

Be of Sound Mind

A valid will requires that you be over the age of bulk, comprehend what property you have, and what it implies to leave residential property to others after your death.

Identify Assets and Recipients

A will needs you to determine the assets and residential or commercial property that are to be bestowed as well as the identifications of the designated recipients (known as called beneficiaries).

Designate an Administrator

A will need to mark an administrator to accomplish the will certainly’s guidelines according to the desires of the deceased.

Witnesses to Your Trademark

For a will to be thought about legitimate, it has to be signed. Numerous territories also call for that the finalizing of a will certainly be experienced by a minimum of two unconnected people, age 18 or over.2 Examine your state legislations for this details.

Kinds of Wills

The 4 primary sorts of wills are the simple will, the joint will, the testamentary count on will, and the living will.

Simple Will

Make use of a simple will certainly to list your properties and the recipients who ought to obtain them. You can also mark the executor and a guardian for any small kids. A simple will certainly is one that can be done quickly online making use of one of different layouts. Be sure to obtain any kind of lawful suggestions you feel you require.

Joint Will

A joint will is one record that includes 2 people, typically spouses. When one passes away, the will is performed for the other spouse, as defined in the will. The provisions can’t be altered by the surviving spouse, which can be an issue if that spouse’s situations alter.

Joint wills aren’t as usual as they as soon as were due to this inflexibility.

Testamentary Count On Will

This will certainly consists of one or more testamentary counts on that take effect after your death and the probate process (unlike, for example, a living depend on which works during your life time). It is utilized in circumstances where recipients, such as small youngsters and/or those with special needs, need certain care over a long period of time. The trust disperses all or a section of your assets after you pass.

Living Will certainly

This type of will just worries your healthcare and decision-making ought to you end up being incapacitated. It is a lawful file that offers directions for your treatment and, to name a few things, the discontinuation of medical support.3 It does not handle a distribution of your property to recipients or other such final dreams.

You don’t require an attorney to create a legitimately acknowledged and approved living will. In fact, medical facilities or your state government can offer living will certainly kinds to you. Each state has details legal demands for valid living wills. Be sure that you understand them before producing one.

Wills vs. Counts on

Wills and trust funds are both essential estate-planning devices, yet they differ in essential ways. Trusts are legal entities created by people known as grantors (additionally known as trustors or settlors) that are designated properties and advise in the personality of those properties. A trustee is designated by the trust fund file to manage and distribute those assets to beneficiaries, according to the wishes of the grantor as outlined in the document.

A trust fund can be created for a range of functions, and there are many types of counts on. Overall, there are 2 groups: living and testamentary. A will can be utilized to produce a testamentary trust fund. You can also create a revocable living trust for the main purpose of staying clear of probate court.

Exactly how to Create a Will

Here are the actions to require to develop a will.

- Consider whether you’ll collaborate with an estate lawyer in a conventional manner to develop your will certainly or produce it utilizing an online solution. Establish contact to get the procedure relocating.

- Select the properties that you want to consist of in your will.

- Call your beneficiaries and the property each ought to get.

- Assign an administrator. Make certain to get their permission initially.

- If you have minor youngsters, designate a guardian for them. Once again, acquire their arrangement ahead of time.

- Authorize your will. 2 witnesses to your finalizing are needed in many states and some may require even more (check your state’s regulations on this and whether your will certainly must be notarized).

- Store your will safely. Take into consideration a risk-free deposit box at your local bank and see to it your administrator is legally licensed by the financial institution to gain access to it.

- Regularly review your will certainly and make updates to it as required.

Producing a will can often be a basic and economical procedure where you fill out a form online without the help of an estate planning attorney. Online will makers allow you to draft, print, and authorize your last will and testament using an online or downloaded and install record developer.

This is a much more cost-efficient method to develop will and count on files compared to going to a lawyer or in-person legal service. The majority of online will makers stroll users through a collection of questions to occupy the called for areas.

Important

There are very important distinctions in between a will and a trust. Unlike a will, which can sometimes be composed on one’s own or using an online will certainly maker, counts on typically are created with the assistance of a certified lawyer, however it isn’t lawfully called for.

Repercussions of Not Having a Will

When a person passes away without a legitimate will, it is stated that they have passed away intestate. This means that the state comes to be the executor of the estate. It chooses just how to disperse the property and that obtains settlement initially, without consideration for a family members’s scenarios. The court can also establish guardianship plans based upon its decision of the most effective interests of the youngsters.

The probate regulations in a lot of states split building amongst the making it through partner and kids of the deceased. As an example, a citizen of Arizona, New Mexico, The Golden State, Texas, Idaho, Nevada, Washington, Louisiana, or Wisconsin who passes away without a valid will needs to have their estate split according to the neighborhood building laws of the state. Area property regulations identify both spouses as joint property owners.

Effectively, the distribution power structure begins with the making it through spouse, who practically usually gets at the very least half the decedent’s estate. They may receive the whole estate if the decedent leaves no living youngsters or grandchildren. If the decedent is single or widowed at the time of death, properties will be split among any kind of making it through kids prior to any other family member. If no near relative can be located, the possessions in the estate will end up being the building of the state.

The Bottom Line

A last will and testimony is a basic legal paper in an individual’s estate plan. It sets out a person’s last wishes referring to their properties. It supplies specific instructions about just how to distribute their ownerships. There are certain points a will certainly can not accomplish for a person, such as decrease estate taxes or help a family totally avoid probate court.

Wills can be easy to create however have demands that have to be attended to in order for them to be considered valid. Please check your state laws concerning a last will and testimony to make sure you take the right actions when creating yours.

ใส่ความเห็น