Benjamin Franklin when stated that there are two things certain in life: death and tax obligations. Though we’re frequently dealt with the latter, we prevent the former until it is too late. Preparation for our very own death is something that many people never think of. We don’t intend to which’s completely understandable.

But leaving this globe without having a plan for your loved ones and your items can create some issues. Let’s discuss why you require a Will.

What Is a Will?

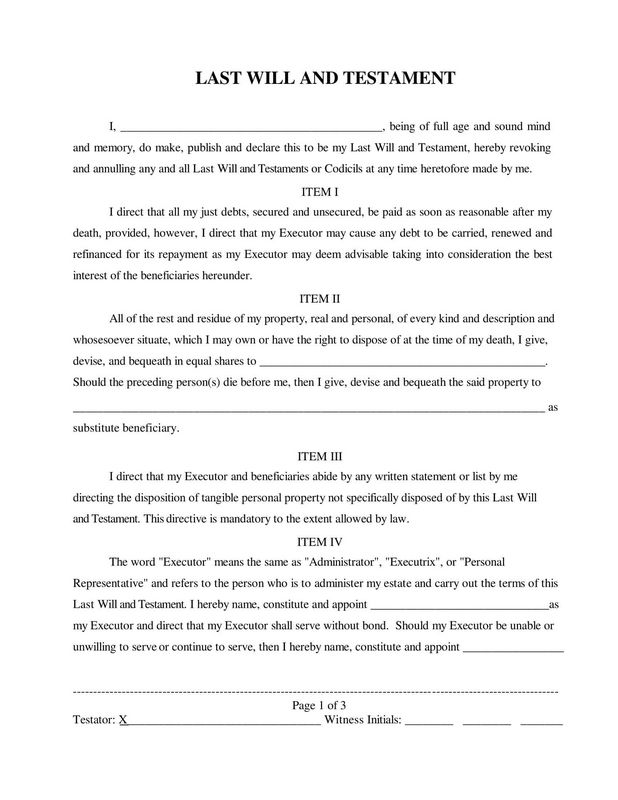

A Will is a legal record specifying your dreams upon your fatality. They typically include the circulation of your property, that will certainly care for children and pet dogs, and sometimes, what your desires are regarding your funeral setups. You might additionally include contributions for companies you are passionate about, ask for unique plans for loved ones (such as the stories of husbands pre-paying for Valentine’s Day blossoms years ahead of time), or demands concerning inheritance.

There are several ways to create Wills, though a popular method is a Video clip Will. The attorney functions as the recorder of the video clip and enables you to resolve your after-life events. It provides the family members one last chance to say goodbye, hear your voice, and enjoy that you were.follow the link maryland last will At our site These Wills are not a substitute for composed Wills and need to be accompanied by a typical Will, in print, to be implemented.

What Happens Without One?

In a word: Chaos. Though you might have made your demands understood to loved ones, they have little legal capacity to enforce them without documentation. Even if your checking account is vacant, you might still have a home, a vehicle, or perhaps a specific ceramic pet cat that 3 of your grown-up kids want in their individual homes. And for those with significant estate left? A Will is a need.

With a Will, each of your properties is thoroughly guided to its new home. Whether it is money, a house, an automobile, or your dishes, everything lands where it is meant to. Without a Will, your member of the family are stuck divvying up your items like a flea market.

Along with this, if you have substantial financial obligation left behind, you may leave a great deal of quarrel to your family members and loved ones. A Will is the best way to assure a simple shift for your family members when you’re gone. Better yet, they aren’t very complicated records and attorneys procedure numerous thousands of them each year.

Implementing a Will

Performing a Will just implies that you’re making it legal. Laws vary from state to state, but in many states:

- You’ll indicator it while you’re still of sound mind and body.

- Have two witnesses sign it at the same time.

- Have it notarized.

That’s it.

You’re completed. You may also choose to attach a self-proven testimony to the Will. This enables the court of probate to accept the Will after your passing without the witnesses present. This is specifically convenient if your witnesses are busy people or perhaps not able to drop what they’re doing in the event of your unforeseen loss. Self-proven Wills are extremely typical in large estates. These are already complex matters and require a good deal of job from the Administrator as it is. Numerous big estate owners make use of self-proving sworn statements to make the procedure much easier for every person included.

Your Executor has nothing to do with implementing your Will, though the two audio very comparable. However they have every little thing to do with the probate court.

What Is Probate?

Probate is the court-supervised process of both carrying out a Will and confirming it. As discussed over, if an affidavit exists this process is usually sped up. As soon as the court has established the authenticity of the Will file, your dreams will be carried out. Executors make use of Wills as guides for determining what goes where, who pertains to any kind of possible analysis of the Will (some families do this, others do not), and totaling out your last expenditures. Taxes, funeral service or cremation costs, sales of items, contributions, and things like that are all part of their task.

When a Trust Is Needed

For those on the wealthy end of the range, a Trust is usually needed. In circumstances where there isn’t a sole family member incredibly conscientious with financial issues, the application of Depend on paperwork ends up being extremely important. This positive financial technique not only adds to the durability of your family members’s wealth yet additionally guarantees that future generations will be well-provided for, cultivating a heritage of financial stability.

Last Ideas

Lack of a Will can make complex the distribution of your assets, potentially creating family members disputes. Luckily, the legal process for creating a Will is straightforward and supplies satisfaction. If you have additional queries or require help with estate planning, we highly suggest talking to an experienced estate planning attorney. Preparation for the future is an accountable and caring act for your family’s health.

ใส่ความเห็น